When you set out to create your monthly budget, you should distribute your income across every spending category, and end up with a $0 balance. Unfortunately, by the time you get to this point, you already feel like you’ve lost control. Eventually, the debt adds up and becomes overwhelming.

They dig a little hole, that just gets a little bit deeper everyday. If you don’t do this, and end up spending more than you make, you can find yourself in a really difficult position.Ī lot of people spend more than they earn. Planning ahead of time will help you manage your money and balance your expenses with your income. And if you find that you don’t have enough money to cover all of them, you’ll be able to prioritize your spending to focus on the things that are most important.

Monthly budget template how to#

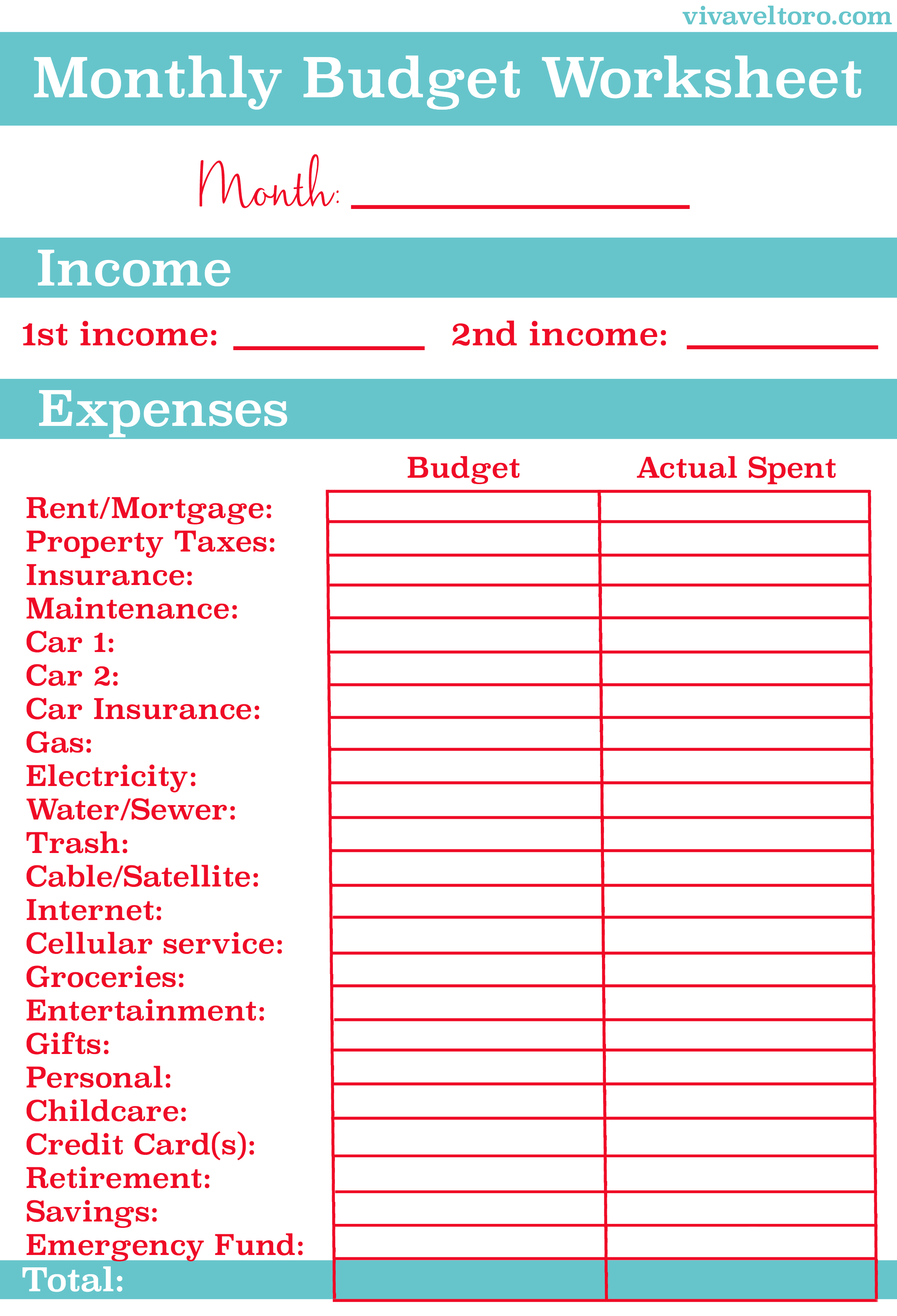

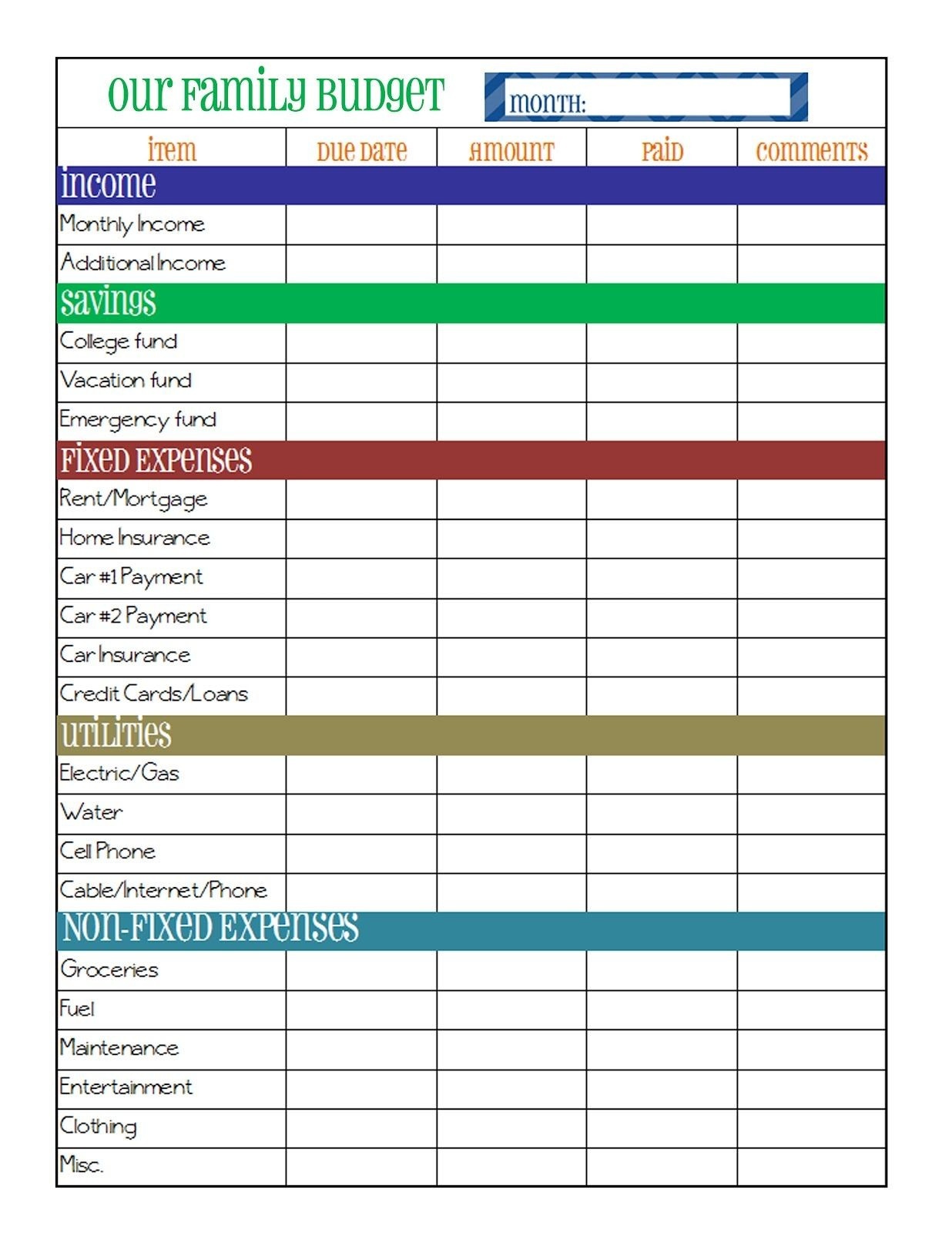

How To Create Your Monthly Budget TemplateĪ budget is an estimate of your income and expenses for a specific time period.īy creating a budget, you’ll know in advance if you have enough money to cover all of your expenses.

Then, we’ll hook you up with our monthly budget template so you can stay on top of your finances with no problem. We’ll show you how you can break down your budget and allocate your funds appropriately. Getting your finances organized can be overwhelming. Are you at the point where you’re in the red every month, but you don’t know where you can cut back?Īre you not sure how to organize your finances or create a budget plan in the first place?

0 kommentar(er)

0 kommentar(er)